What to do if the part-time night job conflicts with the daytime responsibilities?

Balancing a part-time night job with daytime responsibilities can be challenging and stressful. Many individuals find themselves in this situation due to various reasons such as financial needs, career aspirations, or personal circumstances. Explore 퀸알바 effective strategies to manage this conflict and maintain a healthy work-life balance.

Conflict:

Before diving into solutions, it’s essential to understand the nature of the conflict. A part-time night job 유흥 typically involves working during non-traditional hours, while daytime responsibilities may include work, family commitments, or educational pursuits.

Assessing Priorities:

To effectively manage this conflict, it’s crucial to assess your priorities. Identify your key responsibilities both at work and in your personal life. Understanding what matters most will help you make informed decisions and allocate your time and energy accordingly.

Communication and Negotiation:

Open communication with your employer is vital in resolving scheduling conflicts. Consider discussing your situation with your supervisor and exploring options for flexible hours or alternative arrangements that accommodate both your job and daytime responsibilities.

Time Management Strategies:

Implementing effective time management strategies is essential when juggling multiple responsibilities. Create a detailed schedule that allocates time for work, family, and self-care activities. Utilize tools such as calendars, planners, and time-tracking apps to stay organized and focused.

Seeking Support:

Don’t hesitate to seek support from family, friends, or community resources. Informing your loved ones about your situation can help alleviate stress and may even lead to practical solutions or assistance with childcare or household tasks.

Exploring Alternative Solutions:

If negotiating flexible hours isn’t feasible, consider exploring alternative solutions such as remote work options, job sharing arrangements, or temporary leave from your part-time job. Assessing all available options will help you find the best fit for your unique circumstances.

Self-Care and Well-being:

Maintaining your physical and mental well-being is crucial when managing conflicting responsibilities. Make self-care a priority by prioritizing adequate rest, engaging in stress-relieving activities, and seeking professional support if needed.

Decision Making:

When faced with tough decisions, take the time to evaluate the long-term impact on your career and personal goals. Consider whether sacrificing short-term commitments for long-term opportunities aligns with your aspirations and values.

Conclusion:

Balancing a part-time night job with daytime responsibilities requires careful planning, effective communication, and a commitment to self-care. By assessing priorities, seeking support, and exploring alternative solutions, you can successfully navigate this challenging situation while maintaining your well-being and achieving your goals.

...A Step-by-Step Guide to Taking Codeine Phosphate

Codeine phosphate is a medication commonly prescribed for the relief of mild to moderate pain and cough suppression. As with any medication, it’s essential to take codeine phosphate safely and effectively to maximize its benefits while minimizing potential risks. Order codeine phosphate for effective pain relief, with discreet packaging and fast delivery options from reputable online pharmacies.

Consultation with Healthcare Professionals: Before initiating treatment with codeine phosphate, it’s crucial to consult with a healthcare professional, such as a doctor or pharmacist. These professionals can assess your medical history, current health status, and the nature of your symptoms to determine whether codeine phosphate is an appropriate treatment option. Additionally, they can provide guidance on dosage, administration, potential side effects, and precautions to ensure safe and effective use of the medication.

Dosage Guidance: Codeine phosphate should be taken exactly as prescribed by a healthcare professional. Dosage recommendations may vary depending on the severity of pain or cough symptoms, as well as individual factors such as age, weight, and medical condition. It’s essential to adhere to the prescribed dosage regimen and avoid taking more medication than directed, as excessive doses can lead to serious side effects, including respiratory depression and overdose.

Administration Instructions: When taking codeine phosphate tablets or capsules, swallow them whole with a full glass of water to facilitate proper absorption and minimize gastrointestinal irritation. Avoid crushing, chewing, or breaking the tablets/capsules, as this can release the medication too quickly and increase the risk of adverse effects. If using a liquid solution, use the provided measuring device to ensure accurate dosage and shake the bottle well before each use.

Monitoring for Side Effects: While codeine phosphate can be effective in relieving pain and cough symptoms, it also carries the risk of side effects, particularly when misused or taken in high doses. Common side effects may include drowsiness, dizziness, constipation, nausea, and vomiting. It’s essential to monitor for any adverse reactions and report them to a healthcare professional promptly. Serious side effects, such as difficulty breathing, irregular heartbeat, and allergic reactions, require immediate medical attention.

Precautions and Interactions: Before taking codeine phosphate, inform your healthcare provider about any other medications, supplements, or herbal remedies you are currently taking. Codeine phosphate may interact with certain medications, including other opioids, benzodiazepines, antidepressants, and muscle relaxants, leading to potentially dangerous interactions. Additionally, avoid consuming alcohol while taking codeine phosphate, as it can intensify side effects and increase the risk of respiratory depression.

Buy codeine phosphate online to alleviate pain, ensuring safe and timely delivery along with quality customer service assistance.

...Get the advantages of cannabis without the high with Delta 8 Vapes.

Cannabis has been known to have various medical advantages, but not every person needs to encounter the psychoactive impacts associated with it. Delta 8 THC is an extraordinary option for individuals who need to partake in the advantages of cannabis without the high. Delta 8 vapes are turning out to be progressively popular as individuals search for better and more secure ways of consuming cannabis. In this article, we will investigate what Delta 8 carts is, the way it works, and the advantages of utilising Delta 8 vapes.

How do Delta 8 vapes work?

Delta 8 vapes work by disintegrating Delta 8 THC oil, which is separated from the cannabis plant. The Delta 8 THC oil is warmed to a temperature that transforms it into a fume, which is then breathed in through a vape pen or gadget. The fume is consumed by the circulatory system through the lungs, where it collaborates with the body’s endocannabinoid framework.

Advantages of utilizing Delta 8 vapes:

- Pain relief: Delta 8 THC has been shown to have pain-easing properties, making it an extraordinary choice for individuals with persistent pain.

- Anxiety and depression: Delta 8 THC has likewise been found to have anti-anxiety and energizer properties, which can assist people who battle with these circumstances.

- Appetite stimulation: Delta 8 THC has been shown to increase appetite, which can be advantageous for individuals with dietary problems or those going through chemotherapy.

- Neuroprotective properties: Delta 8 THC has been found to have neuroprotective properties, which implies it can assist in shielding the mind from harm.

- Reduced nausea: Delta 8 THC has been found to lessen nausea and regurgitation, making it an extraordinary choice for individuals going through chemotherapy or encountering movement disorders.

Is Delta 8 THC legitimate?

Indeed, Delta 8 THC is legitimate at the government level. Nonetheless, it is critical to take note of the fact that it is as yet unlawful in certain states, so it is vital to check your neighborhood regulations prior to utilizing Delta 8 vapes. To use Delta 8 vapes effectively, you will need a vape pen or device, as well as Delta 8 THC oil. Essentially, fill the vape pen or gadget with the Delta 8 THC oil and breathe in the smoke through the mouthpiece. It is essential to begin with a low portion and progressively increase it until you track down the right dose for you. Delta 8 vapes are an extraordinary choice for individuals who need to partake in the advantages of cannabis without the high.

...How to perform a safe and effective dry horse massage?

You will probably know that horses undergo a lot of physical exertion and tension if you are a horse owner. Massage treatment is a particularly effective way to relieve your horse of these issues. It can result in muscle stress, discomfort, and stiffness, which may negatively impact their performance and well-being. Restorative 건마 massage requires no lubricants or oils yet can offer quite a few benefits to a horse’s physical and psychological health.

- Relaxation of muscles – To relieve the anxiety and firmness your horse may be carrying within his or her muscle groups, 건마 massage therapy is an excellent method. By using these therapies, your horse’s muscles may receive more fresh air and nutrients, thereby increasing flexibility and reducing aches and soreness due to increased flow. As a result of the massage technique, horses that exercise and train rigorously will also be able to prevent muscle cramps.

- Calms and enhances pleasure – Dry horse therapeutic massage can be used to calm down a stressed or excitable horse. It encourages pleasure and calmness just as it does for humans. A horse’s neurological system is soothed by soft strokes and kneading, which can result in a calmer manner and possibly better behavior in the long run.

- Relieving Pain – It’s been said that dry horse therapeutic massage can help horses feel better by using a therapeutic massage method that relieves pain and discomfort. In addition to helping horses with back or neck pain, it will also help horses with chronic conditions such as joint disease, laminitis, and other joint problems. In addition to improving flexibility, increasing joint flexibility, and reducing pain, regular therapeutic massage reduces swelling and encourages healing.

- Digestive enhancement – Your horse’s digestion can be improved by dry horse massage therapy because it revitalizes the muscle tissue in its digestive tract. They can process their food better this way, which can result in better nutrition and healthier life in general. You’ll also be less likely to have digestive problems like colic, an extreme horse disease that can kill you.

- Locates personal injuries and discomforts – Injuries or discomforts you may not be aware of can be identified by dry horse massage therapy. You can target areas of tenderness or discomfort using the horse massage therapist’s effect to address potential problems before they become exacerbated. Horses that participate in high-powered activities like auto racing or eventing, where injuries and muscle strains are common, may benefit from this type of training.

Conclusion

It is, therefore, a low-chance, effective way to take care of your horse’s physical and emotional well-being to give your horse a dry horse massage. Hopefully, this article encourages you to give your horse this therapy and reap its benefits. It can ease pain, ease muscle pressure, aid digestion, and determine probable pain or personal injuries.

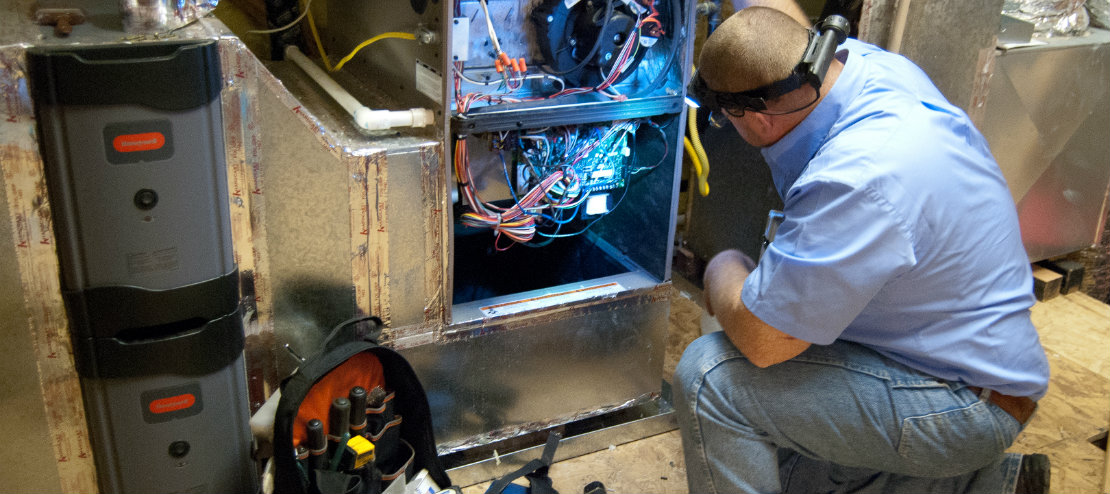

...Importance of pre-purchase inspections when buying a used car

Buying a used car can be an excellent way to save money, but it’s essential to ensure that the vehicle is in good condition before making a purchase. A pre-purchase inspection (PPI) is taken to buy a used car. The PPI involves having a mechanic look over the car closely to find out if there’s anything wrong. It can include examining the engine, transmission, brakes, suspension system, and other critical components of the car. The mechanic will also look for signs of wear and tear, rust or corrosion damage, and evidence of previous accidents or repairs.

Identify hidden problems

Even if you’ve done your research on the make and model you’re interested in purchasing and have checked out its history report online using sites. There could still be underlying issues that are visible without a professional inspection. A PPI helps uncover these hidden problems that may not show up during test drives or initial inspection by untrained eyes. If there are any significant issues discovered during an inspection process to frame damage or engine failures. It provides leverage for buyers to negotiate lower prices with sellers based on repair estimates provided by reputable mechanics.

Safety should always be top-of-mind when driving any vehicle. The one with no history from previous owners might have neglected maintenance. To leads to dangerous mechanical failures while driving at high speeds causing harm to both physical measures such as checking fluid levels regularly through routine oil changes to help prevent breakdowns on busy highways where waiting for tow trucks is never fun. Ensuring proper function across all components ensures peace of mind knowing this new-to-you-car has been given full attention before hitting roadways again.

Avoid costly repairs down-the-line

Investing in pre-purchase inspections now can save you from costly repairs down the line. It’s best to know what you’re getting into before making a purchase rather than discovering issues later and having to spend money on expensive repairs. Cars that have had pre-purchase inspections tend to hold higher resale values as potential buyers feel more confident about purchasing a car with a clean bill of health. Perhaps the most important reason to get a PPI when buying used cars fresno is peace of mind. Having your vehicle thoroughly inspected by a mechanic can help you feel confident in your purchase, and prevent any surprises.

Pre-purchase inspections are part of the process of buying a used car. They can help you identify any potential problems before you make the purchase, saving you time and money in the long run. Pre-purchase inspections also give you peace of mind, knowing that the car you’re about to buy is in good condition and safe to drive. It’s a wise investment to make sure you’re getting the best value for your money when buying a used car.

...Natural Delta 8 THC: The Future of Wellness

What if your cannabis was THC-free, legal across the U.S., and shown to boost brain function, enhance relief from pain and anxiety, and even potentially help you live longer?

The future of wellness is now. Natural Delta 8 THC is a natural compound found in plants that have been designed alongside the human endocannabinoid system. In other words: it’s healthy for you! This blog post discusses its benefits in more detail and how it can be used to enhance overall well-being.

This compound is actually known as tetrahydrocannabivarin (THCV), a type of cannabinoid found in the cannabis plant. The compound was first discovered in the 1960s, with further studies exploring its many uses: for reducing anxiety, improving muscle recovery after exercise, boosting brain function during aging, and more. However, unlike the THC we’ve learned in recreational products, it is non-psychoactive and can be taken without causing a high.

Natural Delta 8 THC is an active ingredient in Phyto Family CBD products. While it may not cause the volatility associated with cannabis extracts like THCV, it still contains the same safety features and features as full-spectrum extracts. Unlike hemp oil or full-spectrum extracts, it is made up of very small amounts of THC. This means that it can be taken in larger doses without causing a high.

This article will discuss the benefits of Natural Delta 8 THC and how it can be used in a wide range of applications to promote overall well-being. If you want to learn more about the history of THC and its link to wellness, read our article on cannabis and the human endocannabinoid system.

Brain Function: Where THC Fits In

First, it’s important to note that Natural Delta 8 THC is actually a metabolite of THCA (another cannabis compound found in full-spectrum cannabis extracts). Converting THCA into THC involves first decarbing with CO2 in a controlled environment (ideally between 103 and 120 degrees Fahrenheit, or 38 – 49 degrees Celsius) before removing it from the final product. This process is also used for things such as making Jet fuel or other organic chemicals.

Natural Delta-8 THC is created when THCA undergoes decarboxylation, the process in which THCA is heated with CO2 to create THC. The reason it’s important to note this is that THCV has shown to be an anti-inflammatory and can assist in reducing stress by increasing serotonin and dopamine levels. It has also been used for reducing anxiety.

As a metabolite of THCA, Natural Delta 8 THC can also benefit your brain function by boosting memory retention and increasing focus during tasks such as studying or performing activities that require concentration. However, unlike THC, it doesn’t cause the same psychoactive effects (i.e., getting high).

This makes Elevate Right Delta 8 THC an excellent option for those looking for a way to boost overall brain function. Even the natural release of dopamine can assist in providing feelings of mental clarity without the negative side effects associated with cannabis use.

THCA has also been shown to help with muscle recovery when consumed prior to workouts, which could also work as a tool for enhancing overall well-being. This makes it an excellent option for athletes and members of the general public looking to improve overall health and well-being.

Think of your muscles as tiny fuel cells that need rest after being under stress during workouts, just like any other muscle group in your body.

...What Are The Benefits Of Using Artificial Urine Kit?

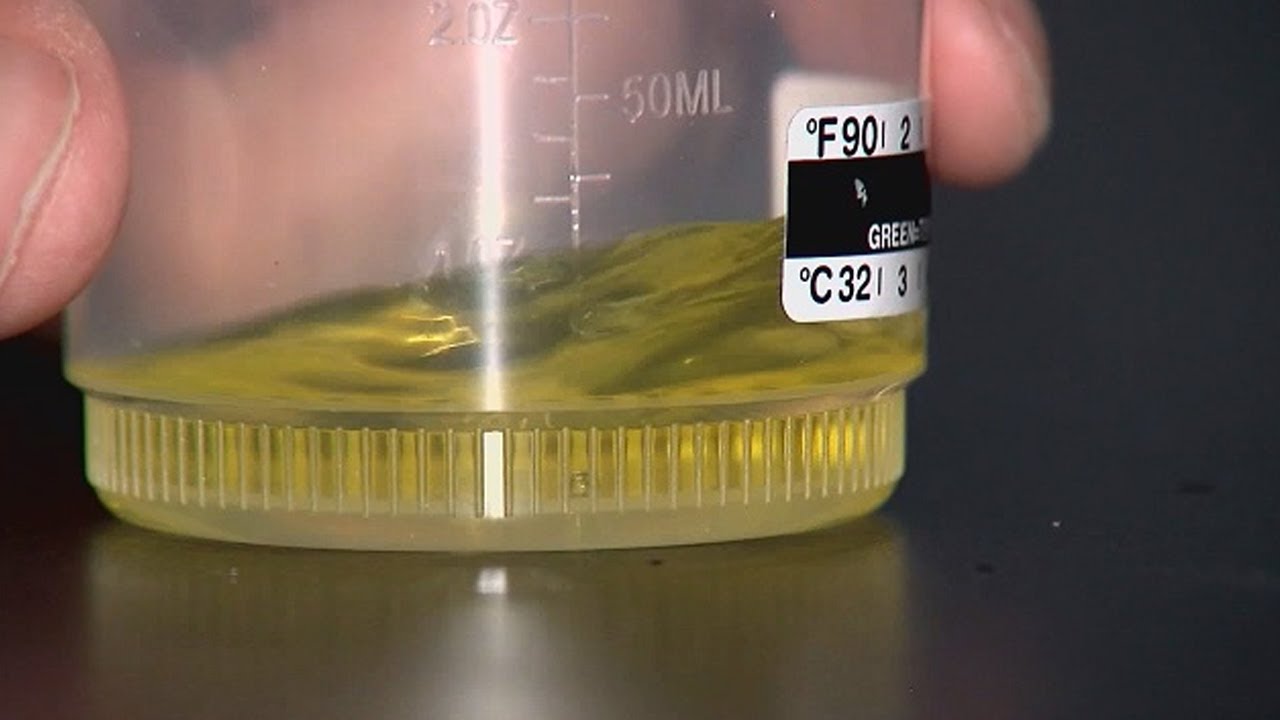

It is imperative to realise that synthetic urine is foamy pee typically purchased to help to pass a drug test. Consider using several synthetic urine products to help you pass the test if you have used drugs. Hence, if you want to pass your drug test, make sure to do your study and figure out how to obtain a Quick Fix. The advantages that you will receive from using these goods are as follows and you can search the Best synthetic urine kits available in market

Utilised to avoid a drug test

The fact that synthetic urine can assist people in drug tests is one of the key reasons most people use it. Make sure to utilise synthetic urine if you are taking a drug test before an interview for a specific job. It is important to remember that it resembles urine in both content and appearance, which makes it a quick fix for people taking emergency drug tests. You can verify and inspect the Best synthetic urine kits available in market for our uses

It Has Scientific Applications

In conducting scientific investigations, it has been that synthetic urine can be employed. According to the majority of experienced scientists, utilising synthetic urine is preferable to using actual human pee. In projects that involve the creation of urine to cure various ailments, they consider using urine. Also, it is highly favoured because it is practical for transportation and can stay for a time.

Educational objectives

Because synthetic urine has the chemical makeup as actual urine, using it to teach and practise urine testing techniques with students is secure and sterile. Nothing may be more critical to our medical diagnosis and care than urine tests. Urine tests identify diseases, monitor nutrition and health, and decide on treatments.

For medical students and clinical researchers who need to practise testing procedures, synthetic urine is the simplest way to simulate the experience of working with actual pee. Poop has improved our knowledge of the human body.

Product testing with bogus poop

Can you use that new washing detergent for a pee stain on your pants? Can you get the smell of pee out of your carpet with that new cleaning product? Fake urine is the test absorbency and leak-control capabilities of diapers. They also use synthetic urine rather than organic whiz on clothes treated to withstand pee. Even cleaning agents that remove urine odours and stains are available as urine testing aids.

Uses in science

According to scientific studies, many people can use synthetic urine. Most seasoned scientists believe that synthetic urine is better than actual human pee. Numerous other sectors make use of synthetic urine because of its benefits. They are using pee-in programs that produce urine to treat different ailments. It is also well-liked because it can endure for a period and is practical for transporting.

Place of other drugs.

Artificial urine has to function just as well as conventional medicine. According to the most recent research, jobs are for medicinal and cosmetic reasons. Also, urinating eases pain. Hence, synthetic urine might be the ideal treatment for skin issues.

...Compensate the nutrients in the body with dietary supplements

Usually, our body depends on the number of vitamins, minerals, and nutrient intake that are good for our health. It is challenging to receive all the nutrients to our body with food alone. The dietary supplements will not involve in healthy eating habits but will provide the essential nutrients required by the body only if taken responsibly. According to a survey, one American takes nutrient supplements every month to benefit their health. Dietary supplements will play a crucial role in leading a healthy life. The phenq is one of the best products and has many positive b. Today in this article, we will look at some information about supplements.

What are dietary supplements?

Dietary supplements contain minerals, herbal ingredients, vitamins, botanical ingredients, enzymes, and amino acids. The supplements are available in various forms like powder, liquid, capsules, and tablets. Remember, dietary supplements are not medicine to cure any problem but, it is regulated by the U.S Food and Drug Administration ( FDA).

Are dietary supplements safe?

For the consumer’s satisfaction, the manufacturing company will ensure the safety of the consumer and provide a quality product. If there is any health problem with the supplements, such as side effects the manufacturers should report it to the FDA.

Before consuming dietary pills, you must know as much information as possible about the product. The internet can provide you with such information, but it is difficult to find whether the information is accurate. You must always consult a qualified physician to make safer moves.

Who will benefit from dietary supplements?

People are using the products for several reasons:

- To maintain their general health

- To support sports-related and mental performances.

- To provide immune system support.

Individuals will need the supplements especially:

- Older adults: older adults will receive problems such as vitamin and mineral deficits in the body compared to younger people. A deficiency in calcium and vitamins may cause weakness in bones, muscles, etc. Taking dietary supplements will help to intake the required amount of nutrients and minerals to make the body healthy.

- People with restricted diets and food allergies: if you have food allergies or a vegan will lack lactose which can be managed with help of dietary food supplements.

Overall, make sure to view the reviews before taking dietary supplements. Remember Phenq review is always positive. You can gather more information from the website https://www.pghcitypaper.com/pittsburgh/phenq-reviews-legit-fat-burner-or-diet-pills-scam/Content?oid=23169845.

...What are CBD Edibles?

CBD edibles are food products, often candy, that contain CBD oil. This sounds very simple, however there can be a lot of variety within them. Since legalization is still relatively new, there isn’t a lot of oversight in the industry yet. For this reason, each company and product may contain different amounts of CBD as well as different kinds of CBD or additions, putting jointly it your duty to examine components and assure that you get what is advertised. (We’ll explore this later.) This is why it’s important to learn a little about CBD first so you can feel confident in your choice products .

How Do CBD Foods Work?

CBD is ingested through boiling, then as it is digested, it enters the bloodstream and takes effect. Since CBD initially be conk out by the digestive procedure, it puts up with roughly 90 minutes for any CBD impacts to take place. Additionally, CBD remains active in the body for much longer than other methods of ingestion CBD tincture.

What are the benefits of CBD food products?

CBD food foods are simple to take, flavorful and easily available. But why we worry purchasing them? Even though CBD research is however largely in its infancy, there have been numerous studies that have demonstrated positive benefits for taking CBD. Studies have shown that CBD can help relieve pain, reduce anxiety and depression, and help you sleep better. The degree to which CBD can help with these conditions depends on many things, including the dose, personal genetics and metabolism, the type of CBD (i.e. whether supplements such as melatonin or other herbs are added to it), bioavailability, and the method of consumption.

Pain relief

Cannabis has been used as a pain reliever for millennia. Anecdotally, there are tons of people across different cultures and generations who praise cannabis for its ability to relieve pain. Until recently, this has been primarily focused on cannabis that contains both CBD and THC, however, we now find that CBD alone is still beneficial as an anti-inflammatory. Being a natural anti-inflammatory, CBD inhibits blood flow and even causes fever and pain to start the healing process in the body. Using CBD edibles provide long term pain relief due to the delivery method. Remember, CBD edibles take about 90 minutes to two hours to take effect, but tend to last anywhere between 4 and 6 hours.

...Weight Loss Vitamins – Things You Need To Know

Weight loss can be challenging, and it may take a little trial and error to find the right combination of food, exercise, and lifestyle for you. But luckily for all of us, there are plenty of ways to help make that process easier. Many ask What Vitamins Help with weight loss, but it is harder to know how many Vitamins you need to take.

If you are ready to start trying to lose some weight and you don’t want supplements, there are a few things you can do on your own. Follow these simple steps and be happy with the results!

1) You need to eat right. That goes without saying. You must avoid sugary foods (pastries, cakes, soda, candy bars), which tend to cause weight gain. Eat healthy food, such as lean meats, fish (completely free of mercury), whole grains (wheat or barley), fruits, and vegetables. Strive for at least five servings of fruits and vegetables every day.

2) Exercise. You don’t need to become a gym addict, but if you can, get yourself there on a regular basis. Taking the stairs instead of the elevator and parking your car farther away from the entrance (or even better, riding your bike) are easy ways to eliminate some of the calories you consume and will help with weight loss. If you have time for it, try doing exercises at home such as push-ups and squats – also effective!

3) Do not drink tap water. Many times this water is “softened” or processed in order to remove all minerals from it, which may cause you to gain weight by making you retain water (water weight). Drink more pure water.

4) If you do choose to use a weight loss pill, make sure it is not one that makes you gain extra weight. Some of them contain diuretics and fat burners, which may make your body hold onto even more water. These types of weight loss pills are very harmful to anyone who wants to get into shape.

5) Take a multivitamin every day as part of your diet. Fruit and vegetables contain no calories, so they don’t add anything to your daily intake except for the vitamins and minerals they provide. It is important to keep your body functioning properly, so the vitamins help lose weight will help you achieve your weight loss goals.

6) Avoid eating before going to bed. Your body uses the energy you consume while sleeping, so if you are not sleeping, then your body won’t use that energy. Eat a small snack at least three hours before bedtime and avoid eating large meals that late either, or eat a meal high in fiber (such as raw vegetables or fruit) for better digestion.

7) Keep track of everything you eat, even little snacks. If you know exactly how many calories and what kind of nutrients you eat for each meal, you can do a better job of weight loss.

...Reasons Why Buying Instagram Views Can Be Beneficial For Your Business

Instagram is a popular and rapidly-growing social media platform. It has more than 500 million active monthly users, and many businesses are using it to reach their customers. Views and followers on Instagram have become very expensive in recent years, but you might not need them—buying views from a service can be just as beneficial for your business.

Here are reasons why you should consider buying Instagram views from an experienced provider today:

- A Popular Platform

Instagram is a very popular platform and has more than 500 million active users. It’s used for sharing photos and videos, for marketing purposes as well as for personal use. People use this platform to communicate with people and to get more followers, likes, views and followers. If you want to reach your audience and make your presence felt on this platform, you need to pay for Instagram views.

- A Unique Data Set

The data offered is unique because it only comes from Instagram users who have used this services in the past. You will find that the Instagram data set is among the best available and a must-have when you want to buy instagram likes.

- The Amount of Views Transferred

Instagram has a maximum limit for the number of views that a profile can receive, which is 20,000 at once. Using this services, you can get as many Instagram views as you want—which is great news for your business!

How Buying Instagram Views Benefits Your Business

Buying Instagram views can be beneficial in many ways, but here are some of them:

- Increase Your Followers and Views

One of the main reasons why people buy Instagram views is to increase the number of followers and views they have on the platform. If a business has more followers or likes, then it will be more visible to other users. Buying Instagram views can help build your brand, increase awareness, and make your brand name more popular among potential customers.

- Acquire More Likes

You can buy Instagram likes to boost your post engagement rate. If you buy Instagram likes, more people will pay attention to your posts—not just fake profiles but real ones as well.

- Attract Customers

You can use buying Instagram views to get customers interested in your products and services. Using this services, you can benefit from a ready-made audience, which will help boost the visibility of your brand name and business.

...Read an unbiased review of the Exhalewell CBD vape cartridge

Cannabis cartridges are known for their quality and are recommended by vaping enthusiasts. The user-friendly and safe designs of the Exhalewell CBD vape cartridges encourage many people to find and purchase one of these products. If you decide to switch to a vape cartridge, then you can research the CBD vape cartridges offered by Exhalewell. You will get the most excellent benefits from the stress-free method to buy and use the suitable product.

Different types of cartridges in disposable and reusable pens encourage everyone to find and order one of these products. Cannabis cartridges are user-friendly, convenient, and easily portable. They let users control the cannabis dosage as they wish. You can contact Exhalewell and discuss significant things about the Exhalewell cbd vape cartridge collection in detail.

Research and keep up-to-date with the CBD vape cartridges

As a beginner to the cannabis vape cartridges, you can focus on how to properly use this innovative method to smoke marijuana. Cartridges are pre-filled with cannabis oil. A vape pen battery in the cartridges powers an atomizer which heats the cannabis oil for activating the chemical components and producing the effects of cannabis.

All users of these products enjoy the clean, safe, and convenient method to vape their favorite tastes of cannabinoids.

All beginners to CBD vape oil cartridges get a good improvement in their approach to buying one of these products. The natural CO2 extraction process is used to refine it. Exhalewell does not use any PG, VG, MCT, or PEG oil in its vape cartridges, unlike other hemp companies. This company uses natural terpenes and gives excellent benefits to its users.

CBD vape cartridges

Disposable vape carts of the Exhalewell include an advanced atomizer that is well-compatible with any standard 510-threaded vape battery. This reliable company successfully offers a wide selection of delicious flavors like the cactus cooler and fruity cereal. You can read unbiased reviews of fan-favorite vapes one after another and discuss anything associated with an easy way to buy a high-quality yet affordable product. You will get the most exceptional benefits from the stress-free method to buy CBD vape cartridges.

Enhancements in the design and development of the Exhalewell cbd vape cartridge products assist many people and encourage them to make positive changes in their approach to deciding on and buying CBD vape cartridges. Testimonials from customers of Exhalewell assist every visitor to this company online to buy CBD vape cartridges as per their wishes.

...Perfect Guide to Know About Your Secret Admirers on Instagram

Instagram is a social media platform on which it’s important to increase its popularity. In simple terms, comments and comments count a lot on Instagram. In addition to that, followers determine the reputation of an individual. There is no doubt about the assertion that one must strive to build an impressive View private instagram presence on Instagram. The process of creating an Instagram account and profile isn’t a problem for those who are new, but it is important to think about what you should do on Instagram?

If you’re also on the exact same vessel, then you’ve come to the right spot. The process of outsourcing your strategies for content on Instagram can be a daunting task. There is an answer for every problem and situation; this is the case of posting content on Instagram. There are a variety of strategies that will help you improve the context of your Instagram profile. Let’s talk about them more thoroughly.

Make sure to share videos that can be beneficial to your followers.

Your readers will appreciate your post they find useful. To draw their attention, you could upload videos using a brand new men’s product. Additionally warning videos are one of the best methods to stand out to the majority of Instagram users. What do these warning videos have to do with it? They can stop people from purchasing products which prove it’s detrimental to your health. The audio and visual performance View private instagram of the film should be top-quality to draw the eye of the viewer.

Sharing behind-the-scenes content

You might have viewed the Instagram profile of male stars. They all share secret content to their fans. This builds trust with your followers. Let them know who you really are and aid them in removing any myths (if they have any). To receive a more positive response, create videos with an organization that has been taught to be successful.

Go Live!

Live video has always been the most effective way to get people to participate. For companies, they prove to be a great way to strengthen customer relations. When it comes to the launch of a new product or other business events, live video can be used as a platform for Q&A to answer your customers’ (or potential customers’) concerns. It is important to inform your followers beforehand about the live video because it serves to remind your followers to attend the live stream.

Change to content created by users

Content that is created by users can be a great source of content for your current followers. Keep in mind that your followers love the content created by users and would appreciate the repost. It assists new followers recognize your popularity on Instagram and motivates them to stay connected with your View private instagram followers. To get the most effective Instagram posts for men You should take the time for quick research to ensure duration of content.

...Treat ADHD with Natural Adderall alternatives

You may come across many pills and plants while looking for natural Adderall, but few are likely to be effective. There are Adderall alternatives, but it’s important to note that these products don’t function similarly.

Natural Adderall Alternatives are used without any adverse side effects or prescriptions. These dietary supplements include tyrosine, caffeine, and L-theanine. All of these components have been demonstrated to enhance general cognition and focus. They also can lessen tension. The best thing about utilizing these remedies is that there are no adverse side effects and that anyone, regardless of age, can take them.

What are the natural alternatives to Adderall?

- Caffeine:

The stimulant caffeine aids in improving the focus of those with ADHD. Additionally, it increases the brain’s dopamine levels. In overactive brain parts, it acts as a vasoconstrictor to constrict blood vessels. The use of caffeine should get avoided six hours before bedtime. For those who want to attempt a natural Adderall substitute, it might be advantageous.

- L-theanine:

L-theanine is more calming and focused. Additionally, it can enhance your mental health and lower your blood pressure and heart rate. It also makes sleeping better. Black tea frequently contains theanine, which millions of people also get via supplements. An excellent dietary supplement for improving focus is L-theanine.

However, for many Adderall users, it can help lessen the drug’s unpleasant side effects and offer a natural alternative.

- Citicoline:

The natural supplement citicoline has been shown to increase mental clarity and metabolism by up to 13.6%. All living objects and cells contain this biological substance. It increases acetylcholine production and enhances blood flow to the brain. Additionally, it enhances memory, focus, and mood.

There are 13 natural elements in this supplement, all of which work to enhance cognitive performance. Some of these components enhance brain blood flow and aid sports performance.

- Rhodiola Rosea:

A natural vitamin called Rhodiola Rosea Energy has a lot of helpful components. Additionally, it promotes mental clarity and relaxation by calming the brain. Additionally, it improves blood flow, which is crucial for improved brain function. Rhodiola Rosea can increase energy levels as well as reduce stress.

According to research, Rhodiola Rosea enhances memory and cognitive function in healthy adults. The plant is also efficient in treating ADHD in children.

There are many more options available before Adderall. But here are some of the most suitable medicine or natural Adderall alternatives that you can use for the best results.

...Ways to Conduct Amazon Product Research Like a Pro

Experts emphasise market evaluation if you want to make a lot of money as an Amazon seller. As a result, it is critical to conduct thorough amazon product search before jumping in full-time. Because the process of being an Amazon seller can be stressful, newcomers may look into alternate business tactics such as retail arbitrage. But trust us when we say that every successful Amazon seller has gone through this stage. Choosing the best bankable product is not as difficult as it appears.

Therefore, let’s begin.

What Does Amazon Product Research Mean?

Amazon Product Research is all about researching current market trends in order to select “winning” goods – items that may produce a lot of revenue.

The goal is to look for things that you can obtain cheaply and then offer at competitive pricing with a high profit margin. For example, you may be able to sell athletic socks for $2 per pair, but if they aren’t that excellent, you may receive bad feedback from your clients, resulting in minimal sales.

The first and most important step in getting started as an Amazon seller is to identify a killer product. Most people who look at FBA will never start until they can come up with low-competition, high-demand, and private label items.

Amazon has progressed to the point where simply putting on a great logo and developing special packaging is no longer sufficient. With an expanded number of sellers and stricter selling regulations, it is critical to recognise that the traditional tactics for identifying items will no longer function in the present environment.

You must make a list of the best-selling Amazon items that you want to sell. Then, see whether similar things are selling well. This step is critical since you never want to trade products that no one is looking for.

Amazon Product Research Requirements Checklist

Here is a simple checklist of what is needed to create the best product. Your work becomes easier with these parameters.

- Prices for products ranging between $10 and $50

- Products that generate at least ten sales every day

- Similar goods with at least a 5,000 best seller rating in the main category

- The top three related keywords receive over 50,000 monthly searches on Amazon.

- There are no seasonal goods. They can sell 2-3 things with fewer than 50 reviews on the top page all year.

- Products that are small and lightweight (under 2 to 3 pounds)

- The product has no brand names or trademarks linked with it.

- A product might be priced at 25% or even less than its retail price.

- Appropriate space for product optimization and upgrading of current listings

- Several product-related keyword possibilities

- Product procurement from China should be quick and simple.

- The product should not be delicate.

- Capability to develop your brand with complementary items

- Can create a superior product in comparison to similar items on the market

- The product encourages repeat purchasing

- There should be no legal difficulties with the goods.

Looking For The Best Delta 8 THC Brand Online

As a cannabis enthusiast, if you are looking for the best delta 8 THC brand online, this is the right article. Every marijuana patient has different needs and concerns, and I am here to provide you with all the information you need to make an informed choice when choosing your legal weed oil.

Cannabis is one of the most commonly used recreational drugs today, and people of all ages enjoy its many benefits, from alleviating pain to boosting mood. However, there is a risk of overconsumption with marijuana use that can lead to negative effects such as respiratory issues or other health problems. Budpop Online hemp store CBD is a revolutionary alternative to marijuana that is potent and effective.

Delta 8 THC fromBudpop Online hemp store is one of the most popular brands of bud pop online, and it can be purchased in many different forms, including oils, capsules, and even edibles. These products are available at a range of locations, including marijuana dispensaries and shops located throughout the United States. When purchasing delta 8 THC products online from budpoponline.com, you will benefit from a wide range of benefits, including stealth shipping, 24/7 customer support, and fast delivery.

Delta 8 THC is designed to help you relax and unwind without any negative side effects associated with regular marijuana use. The delta 8 strain is one of the most preferred forms of bud pop online, and it can be helpful for a wide range of health concerns. Some people use this product as a sleep aid or to alleviate symptoms associated with stress, depression, or anxiety.

Delta 8 THC products are made using high-quality ingredients to ensure you get the highest possible benefits. Many users enjoy reduced symptoms associated with chronic muscle pain, nerve pain, migraines, or nausea after using this product. Delta 8 THC products contain various active ingredients, including Cannabidiol, Terpenes, and an Indica Dominant Hybrid.

Delta 8 THC products from budpop.com can be bought from a wide range of locations and are available to customers all over the United States. They are discreetly packaged in blister packs or containers that preserve their freshness. The company’s high-quality oils are sold at reasonable prices with fast and discreet shipping throughout the United States.

Customers who buy delta 8 THC products online benefit from a wide range of benefits, including discreet shipping, fast delivery as well as high-quality ingredients. When you purchase delta 8 THC products online, you will get all the information you need to make an informed decision. Delta 8 THC is a revolutionary alternative to traditional marijuana, and it can help you get the relief that you need every day.

...Several good reasons why you have to make money online?

The vast majority would agree that that bringing in cash online is phenomenal. These individuals are valid, and there are valid justifications for it. Bringing in cash online is likewise a method for enhancing your pay so you will not need to live from one check to another any longer. Others even make a totally new vocation from getting it done. Learn how to make profit on amazon and improve your business income.

Bringing in cash online isn’t quite as convoluted as it sounds, and many individuals have proactively partaken in its advantages. While these people have various motivations behind why they do online hustles, they all concur that it’s a staggering method for getting by. Read below to know more.

- You likely have encountered receiving irritated by an email from your boss at work, instructing you to accomplish something in view of a crisis regardless of whether you’re at home chilling. Everybody loathes that inclination, and the best way to forestall it is the point at which you become the chief. At the point when you shift into doing independent activities or gigs, each achievement you experience and each choice you make is your own.

- Perhaps of the best thing about having a web-based work is that nobody can direct you where to work. While it’s great to set a work space up, you’ll constantly have the choice to work in your number one café or be on an out of the nation excursion nevertheless work.

- The main motivation why bringing in cash online is something you ought to begin doing now is the chance of having a boundless pay. This is conceivable since you’ll have the choice to take on numerous activities or clients so that you’ll have a few group paying you for each hour of work you do.

- The vast majority who presently bring in cash online have begun as corporate employees, and they have seen the hole as far as the adaptability you’ll appreciate between the two kinds of work. With online positions, you can work anyplace you like and settle on the quantity of hours to designate in finishing responsibilities, among others. Explore how to make profit on amazon by just using their services to get your business and sales be taken to a huge number of people without any kind of trust issues at all.

Know All About Delta 8 Flower And Further

There’s a good chance an individual would’ve heard about delta 8 flower, commonly known as D8 flower, and smoking it. However, one might not be entirely certain of what it is or the reasons for its rising popularity. The Delta-8 THC flower, which is a classic hemp flower augmented with the Delta Tetrahydrocannabinol (THC) extract, is highly praised by cannabis consumers all over the world. Although this modification to hemp blossoms does not occur naturally, the finished product, when smoked, is rather pleasant.

Delta 8 Flower: What is it?

The “delta 8 flowers” do not happen naturally since delta 8 is just found in about 1% of marijuana plants. Delta-8 flower, on the other hand, is hemp flower with delta-8 THC added. 50% part of organic development and one part of man-made modification make up the Delta 8 flower. It employs the hugely well-liked Delta 8 THC distillate. In essence, buds are altered by specific procedures that incorporate Delta 8 extract. This produces the popular Delta 8 flowers that are in high demand.

How Are Delta-8 Hemp Strains Storied?

The directions for storing delta-8 flowers may usually be determined by the package that the plant is delivered in. The delta-8 flower has to be kept out of direct sunshine in a dry location. The fridge is not the best place to keep delta-8 flowers since the temperature there would be too low for the species. The box the flower arrived in completely seals, protecting the bud from withering out and becoming contaminated, so one can keep it there.

An Inward Look at How Smoking Delta 8 Flower Makes an individual Feel Delta 8

Now on to the important part. People looking for a good time as well as those seeking a similarly laid-back high prefer the delta 8 flowers. People who smoke Delta 8 flower also claim that it improves focus. Even potential motion sickness may be reduced by the therapeutic advantages of Delta 8 flowers.

Understanding the differences between CBD Hemp and Delta 8 Flower

A buzz or high is not produced by CBD hemp flower. The THC content in industrial hemp is a pitiful 0.03%. Delta 8 flower, on the other hand, gives off a pleasant buzz. Although there are many different CBD hemp flower varieties and some of them taste like marijuana, Delta 8 flower provides a superior smoking experience. Hemp is a plant, as the majority of people are aware. Some people call this naturally occurring plant a flower. The growth of delta 8 THC does not resemble that of a real plant. A small amount of delta-8 THC is present in hemp plants.

...What You Must Know About bad credit loan

Bad credit loans help people who can’t qualify for a traditional loan by providing them with a fast, low-interest loan. With bad credit loans, applicants can be better credit scorers than they do for other types of funding. Helping to ease the financial burden of repaying it even further is the fact that, in many cases, bad credit loans have no official documents required, and they’re typically approved within minutes.

Best Bad Credit Loans Of 2022 – ktnv.com are a great solution when you need money for something you can’t afford in cash. Whether your car needs an engine part replaced or you need to buy new furniture, a bad credit loan can help. You don’t have to pay high-interest rates or go through all the paperwork like with other funding sources. Most loans require you to provide very little information on where the funds will be used and how many years it takes you to pay them back before they even consider approving your application.

There are many different types of bad credit loans available today. There’s a wide variety of lenders just waiting to lend you money, and most will be willing to give you an interest rate lower than the going rate on standard financing. However, be sure to carefully read the fine print and make sure that you know what your loan options are before you apply for one.

A bad credit loan is a consumer credit loan offered to people with a poor credit history or those with no credit history. It can be used for buying anything from furniture, cars, and appliances to home improvements, entertainment, and miscellaneous items. These loans are helpful to people with bad credit who have been denied financing or funding by other institutions.

In recent years, third-party lenders have emerged and have provided consumers with a convenient way to obtain bad credit loans. With the emergence of the Internet, finding a lender has become very easy. Some of these lenders have also made it easier for people with low income or bad credit to apply for a loan. This article will discuss why you should consider getting yourself one and how they can benefit you in your day-to-day life.

Consider a personal loan if you’re searching for a way to consolidate debt or cover emergency expenses. It can help you achieve more excellent financial stability and a plan for paying off what you owe. You may have to work with your lender to create a repayment plan that works for you to address your current financial situation

...Things to plan before selling any products online

You need to bring in additional cash as an afterthought, so you investigated a few web-based business thoughts and concluded that making a web-based store is the best approach. The following platform is where beginners frequently battle the most: picking which items to sell on your web-based store. Explore amazon sell calculator that helps you know about the demand of any specific product on amazon.

Before you begin researching items that you can sell, there are a fundamentals that you really want to remember. They are as follows,

- To begin with, you want to pick a platform that you need to use to sell your items. Picking the right Online business platform is significant in light of the fact that it will influence your selection of items and how you carry on with work.

- If you need specialized abilities and need a faster method for building a web-based store, then, at that point, you might need to investigate some simple connection point shopping webpage. A completely facilitated plan deals with all the specialized stuff. The catch here is that you will be paying somewhat more, and your costs will develop as you make more deals.

- Shipping tremendously affects the outcome of an Internet business store. A review led by Business Insider found that higher delivery costs are the number one reason for all unwanted shopping baskets on the web.

- These are items that everybody needs and are sold by numerous little and huge stores with next to no distinction in quality. For instance, ordinary items like cleanser, cereal, from there, the sky is the limit. These items are made by probably the biggest brands in the retail business and are accessible generally with next to zero contrast in cost. These are items that are extraordinary or hand-made, accessible in restricted stocks, and from explicit providers. Consider home-made cleansers, curiosity shirts, ceramics, gift things, programming, and incalculable different items. Since these items are not generally accessible, they give you an upper hand.

- Try not to figure about choosing items to sell on the web. Back it up with information so you realize there is an interest for these items and clients are searching for them. The primary instrument you will use for your research is Amazon. Get to know about amazon sell calculator where you can estimate how much sale you could make on any chosen product that you want to sell.

Delta 8 gummies: A Safe and Effective Way to Enjoy the Benefits of Cannabis

If you’re looking for a safe and effective way to enjoy the benefits of cannabis, Delta 8 gummies are a great option. These gummies are made with CBD and THC, which are both known to have therapeutic benefits. Delta 8 gummies are also non-psychoactive, so you won’t experience the same “high” that you would from smoking marijuana.

Delta 8 gummies are available in a variety of flavors, so you can choose the one that best suits your taste. You can also find gummies that are infused with other natural ingredients, such as melatonin, to help you sleep better at night.

Delta 8 gummies:

Delta 8 gummies are a type of cannabis edibles that are made with CBD and THC. These gummies are non-psychoactive, which means you won’t experience the same “high” that you would from smoking marijuana. Delta 8 gummies are a great way to enjoy the benefits of cannabis without the psychoactive effects.

Benefits of Delta 8 gummies:

Delta 8 gummies offer a variety of benefits, including relief from anxiety, pain, and inflammation. CBD and THC are both known to have therapeutic benefits. Delta 8 gummies are also non-psychoactive, so you won’t experience the same “high” that you would from smoking marijuana.

Delta 8 gummies safe:

Yes, Delta 8 gummies are safe. They are made with CBD and THC, which are both known to have therapeutic benefits. The top rated best delta 8 gummies are also non-psychoactive, so you won’t experience the same “high” that you would from smoking marijuana.

Take Delta 8 gummies:

Take Delta 8 gummies:

Delta 8 gummies are taken orally. Simply chew and swallow the desired amount. Delta 8 gummies are a great way to enjoy the benefits of cannabis without the psychoactive effects. Do not consume Delta 8 gummies if you’re pregnant, breastfeeding, or have any pre-existing medical conditions. Please consult your doctor before use.

Side effects of Delta 8 gummies:

Delta 8 gummies are non-psychoactive and therefore do not produce the same “high” that you would from smoking marijuana. There are no known side effects of Delta 8 gummies.

Buy Delta 8 gummies:

You can purchase Best Delta 8 Gummies online or at a dispensary. Delta 8 gummies are a great way to enjoy the benefits of cannabis without the psychoactive effects.

Conclusion:

If you’re looking for an alternative to smoking marijuana, Delta 8 gummies are a great option. These gummies are non-psychoactive and made with CBD and THC, which are both known to have therapeutic benefits.

...Is Marijuana OK From A View?

Medical marijuana has been used for healing for thousands of years. It was discovered that the herb had medicinal properties in India, China, and the Middle East. Queen Victoria and her doctor pioneered medical marijuana use. The herb was widely used in America before the Stamp Act of 1920s, and other marijuana laws. Patients with asthma, A.I.D.S., and cancer today praises marijuana’s virtues.

The History

Marijuana, or Cannabis Sativa as it is scientifically known, can be grown wild in mild environments. Many Asian countries include medicinal cannabis on their healing herbs lists. This was long before activists and teens of counter culture tried it. Chinese were the first people to use Effective THC detox methods cannabis. In the 28th century B.CEmperor Shen-Nung wrote about medicinal marijuana’s therapeutic effects. Emperor Shen-Nuan wrote of its benefits in treating constipation, rheumatism, and other conditions.

What’s it used for?

Medical marijuana can be used in many different ways. Doctors may use medical marijuana to make Effective THC detox methods liquids that can be consumed. Some doctors believe that pot is more effective when it is eaten. Smoking medical marijuana is another way to harness its healing properties. Doctors may use marijuana to crush it into a poultice, or an ointment.

Similar California Laws

California is currently at the center of legalization efforts for marijuana. Since Prop 215 was passed, Californians have opened a variety of medical marijuana shops. There are marijuana vending machines in many places throughout the state. California residents can legally obtain medical marijuana from any state dispensary by obtaining either a California medical marijuana card (or a Cannabis Club card). Before they can get a card, Californians will need to have their marijuana examined by a doctor who is qualified in medical marijuana.

California allows you to open a medical marijuana dispensary. California has many medical marijuana evaluation centers that are able to issue medical marijuana licenses. While decriminalization is a major step, many cannabis activists pledge to make marijuana legal in California. Many people support medical marijuana. The members of the marijuana legalization movement feel confident they will succeed.Smokers are often excused for their alleged peace of Effective THC detox methods mind. Although they may feel more peaceful if they don’t smoke, their suffering is not being transcended in any meaningful way. They only experience temporary relief from their emotional discomfort. They can’t address the pain and that is a problem. You can’t deal with something if you don’t feel it anymore. Keep pushing them down until they’re out of your conscious awareness.

...Why You Need To Buy CBG Flower Online

Buying CBD hemp flower online is easy to ensure that you always have a safe and legal supply of CBD at your fingertips. Why, you might ask? Well, it’s because CBD hemp flower sourced from a high-quality plant is the most potent, natural form of CBD. Click Here to visit official site https://cheefbotanicals.com/cbg-flower/.

The online market for CBG flowers has exploded in recent years as more and more people are looking for affordable, safe products without the inconvenience of local laws. When buying CBG flowers online, you’ll find that they are usually less expensive than when purchased in person, and they offer much higher concentrations of active ingredients (such as THC or CBD). Plus, ordering these products anonymously through the mail allows users to order discreetly without worry.

But if you still need to convince that you should be ordering CBG flowers online, check out this infographic and article we’ve put together to show the benefits of buying CBD flowers over the phone or at a dispensary.

Even though hemp and marijuana have similar uses, they’re pretty different. The marijuana Trichomes all over the flower will not contain much THC, about 0.3%. In contrast, hemp trichomes are dense and full of cannabinoids with much higher potency. The flowers have trace amounts of THC at best (0.3-5%) compared to the plant’s concentrated resin. The concentration of THC and CBD in CBG flower is much higher than in any other part of the plant. It’s estimated that there can be up to 15% CBD and 1% THC in the flowers, which growers often discard.

CBD hemp flower online can treat various conditions like anxiety, depression, inflammation, skin problems, and addiction. When ordering CBD flower, you will have access to a broader range of cures than you can get by just consuming CBD as if it were in a capsule.

Additionally, CBD flower is a lot more potent when it comes to getting the results you want. There are several ways to take CBD, including smoking the leaves or flowers (a common form of ingesting marijuana), drinking it as tea, or making homemade extracts. Due to its natural ingredients, you never have to worry about any side effects of CBD, whereas prescription medications sometimes contain harmful side effects.

But, when it comes down to it, ordering CBG flowers online is one of the most discreet ways to get your hands on this miracle plant. You won’t have to deal with the inconveniences of buying in person unless you want them.

...Personal Loans With Bad Credit: Why Guaranteed Approval Is Impossible

Aside from the fact that credit scores are just not definitive enough to guarantee one’s loan application will get approved, personal loans with bad credit can cause a variety of other problems. Many lenders may offer high-interest rates or require collateral in order for one to borrow money. This could result in an unmanageable debt with no way out.

The good news is that it is possible to get bad credit loans guaranteed approval or putting yourself at any risk of incurring unnecessary costs. If you’re looking for a personal loan with bad credit, you have to consider the following factors:

Cost: A personal loan can be a great way to secure funds for various purposes. The idea is that you are able to borrow money at an affordable rate. However, there are many steps involved with obtaining a personal loan with bad credit, and different lenders may charge different interest rates. There are still ways to reduce the cost of your loan. It is possible to negotiate with your lender in order to obtain a low-interest rate on your borrowing. Collateral: Not all lenders will require collateral for a personal loan with bad credit, but some may require high-interest rates or require one to put up collateral as insurance against possible future loses (i.e., repaying the loan in the event of death or job loss).

It is possible to look for lenders that are willing to give you a personal loan with bad credit if you provide your employer’s payroll stubs, past tax returns, and other things that could show your ability to pay back loans. Lenders may require a down payment of 10 to 20 percent of the total amount borrowed. Your financial situation: It is always best to take loans on a shorter-term basis in order to avoid incurring high-interest rates over long periods of time.

Additionally, for those who may need a large amount of money for personal reasons, it is best to borrow a little at a time (e.g., $1,000) in order to spread out the repayment schedule and avoid high-interest rates over the course of many years. One must keep in mind that they are taking on debt, and the debt will not just disappear if they do not pay it back.

A Personal Loan is a loan that is used for personal purposes only and does not have to be paid back until you can afford to do so, unlike credit cards which require minimum monthly payments and have variable interest rates.

In conclusion, if you want to get a personal loan with bad credit, the best thing that you can do is to take a closer look at your overall financial situation and compare it to the different options offered by your lender.

...Why Buy Exipure Weight Loss

If you’ve ever wanted to buy Exipure Weight Loss, the choice is between exipure and exercise. Unfortunately, the choice is not easy. There is one such option that stands out above all others, but there are plenty of things to consider before buying a product like this.

exipure weight loss offers plenty of positives for those who can manage their hunger and cravings. These supplements are designed for people who have trouble with dieting due to their inability to turn off their feelings towards food, even when they are trying very hard not to eat it. These supplements are about so much more than simple dieting. They are about making weight loss easier.

Managing the hunger and cravings that you get from not eating the food that you want is difficult when you struggle to turn off your feelings toward food in your brain. It certainly can be done, but it is not easy. Usually, Exipure Weight Loss is recommended for those who had tried other types of weight loss without success or have even gained back the weight they lost (and then some) when they stopped using a product like this. Exipure reviews have been sung in the best possible terms, and these are the reviews that are all over the internet.

Exipure is available on Amazon, and this is a good thing. There are many people who use a product like this, but it truly can only be recommended for those who have tried everything else and have failed in all other aspects of their weight loss efforts.

Many people who buy a product like Exipure do so because they have failed to lose weight before. So, they pick up a bottle of these pills with hopes of doing better than they did before. If they buy Exipure Weight Loss, they might actually do much better than before.

The main thing you have to keep in mind is that if you try Exipure Weight Loss but don’t like the way it works for you, then it will be a waste of money. The supplement has benefits, and it can help people with weight loss, but no one else should buy this product for their particular issue.

If you want to buy Exipure Weight Loss, read more about the website. There are many people who would recommend that you check out the website before buying the product. You might also want to check out reviews of other products before making a decision about which one you should buy.

In conclusion, Exipure reviews are all over the internet, but most focus on the effects of these pills and not just how to use a product like this. Don’t be fooled by Exipure Weight Loss reviews that do not tell you how to use the product.

...Would you like to improve your health and get rid of liver problems?

As many people face a busy lifestyle, it can be hard to stay in good shape. A liver detox is an excellent way to enhance your liver function and achieve better health. As well as helping you combat liver disease symptoms, the best liver health supplements program can also help you to lose weight, feel tired, and experience abdominal pain, nausea and vomiting if your liver isn’t functioning properly. You may even get jaundiced if things keep getting worse.

It is best to take precautionary measures to prevent all of these problems. A liver detox can help you retain optimal liver functions while reducing inflammation and removing toxins from the body. Milk thistle and artichoke leaf are essential ingredients in liver detox supplement. They can help protect liver cells from inflammation and scarring. Beetroot, ginger, turmeric, zinc, and many others are important ingredients for liver health in the best liver detox programs.

The supplements can be easily purchased online or at a physical store. It would help if you bought them from reputable sellers, as many make bold claims without delivering health benefits. Providing you with the best market supplements means separating low-quality from unreliable ones. That is why we filter out the low-quality and unreliable ones. You’ll find out how we got our results here and the top 4 liver detox brands on the market.

Orwell Liver Detox is a leading liver supplement known for its gradual, smooth detoxification, which helps maintain a healthy liver and regulates activities such as lipid metabolism. Orwell Liver Detox uses quality and potent ingredients to protect your liver. For instance, milk thistle helps to cleanse your liver. It also contains herbal extracts, vitamins, and minerals. In addition, you’ll get a boost in overall immunity during this pandemic, which we can all use.

You’ll also prevent fat accumulation and inflammation by using the program. Clinically tested and approved ingredients make up Oweli Liver Detox. As a result, the ingredients are free of heavy metals, pesticides, and other health-risk pathogens. Furthermore, manufacturing is conducted in an FDA-approved facility. The supplement is free of contaminants, so that you can buy it confidently.

Unlike other brands or products, Oweli Liver Detox has numerous liver benefits you can observe. Per the manufacturer’s claim about the product, 99% of customers have reported that they experienced quick and reliable results from the Oweli Liver Detox. It boosts immunity, supports liver health, and eliminates toxic elements from the body.

...Things To Know About About Hemp Flowers

Hemp is a variety of the Cannabis plant that has been cultivated and used for thousands of years. It can be utilized to manufacture textiles, paper, and plastics, as well as foods, biofuels, and pharmaceuticals. Today, hemp is also being advanced for its use in the production of uniquely healthy personal care products. Visit the official website https://www.exhalewell.com/cbd-flower/ to learn more.

There are wide different varieties of cannabis plants around the world. The Cannabis Sativa L variety is most common in North America, but Hemp strains have been found to be more adaptable to other climates like Europe, where they yield higher quality fibers than some other varieties. Today, there are many kinds of hemp flowers available that can produce various products such as fibers, health foods, bio-fuels, and cosmetics.

But before we get into the different varieties of Hemp flowers and their benefits from them, you should first learn about the basics of hemp.

Hemp Flower Buds Hemp flowers have a lot of health benefits. Here are some of the most important ones that you should know: The cbd flower buds contain virtually no THC and are, therefore, safe to consume during pregnancy. This is why many people in the medical field recommend it prior to birth.

Hemp Flowers contain very little THC. This is due to the fact that they are not produced as industrial products which focus on THC as their main ingredient (like an oil or resin). Many people do not use flowers during pregnancy because they think that this might be harmful to their unborn baby. The hemp flower buds are one of the very few natural products that can be consumed during pregnancy because it contains no THC at all.

Hemp Flowers contain very little THC. This is due to the fact that they are not produced as industrial products which focus on THC as their main ingredient (like an oil or resin). Many people do not use flowers during pregnancy because they think that this might be harmful to their unborn baby. The hemp flower buds are one of the very few natural products that can be consumed during pregnancy because it contains no THC at all.

The hemp flower buds are often used in Mexican and Asian dishes. It is very versatile in that sense and can be used to create many different types of food. In Asia, hemp buds are commonly used in soups, salads, and other forms of cuisine.

Hemp flowers have a high content of essential fatty acids (omega 3, 6 & 9), which contain anti-inflammatory properties as well as enhance human memory retention & how we learn new things. They are easily absorbed by the body’s cells which makes them easier to digest than other oils.

Hemp flowers are one of the most nutritious foods in the world. They can be used by people with diabetes to easily regulate their blood glucose levels and also help stop excess bleeding. Hemp is also very high in protein which means that it helps build muscle tissue and repair body tissues more easily than other sources of protein. Hemp flowers are also a good source of vitamins K & C, as well as many vital minerals that support healthy bone structure, skin, hair & nails.

...CBD Gummies for Anxiety: Follow These Natural Home Remedies

Have you ever been diagnosed with anxiety or have anxiety in your life? Anxiety can feel like a dark cloud that is constantly hanging over your head, causing a lot of stress and anxiety. CBD gummies are a great natural home remedy for the symptoms of anxiety.

Have you ever been diagnosed with anxiety or have anxiety in your life? Anxiety can feel like a dark cloud that is constantly hanging over your head, causing a lot of stress and anxiety. CBD gummies are a great natural home remedy for the symptoms of anxiety.

What are the symptoms of anxiety?

The most common symptoms include racing heartbeat and shortness of breath; palpitations, shaking, trembling; fearfulness, irritability, and sleep problems. These also include headaches; inability to concentrate; pounding heartbeats at night which interrupts sleep cycles; muscle tension and physical pain that includes allodynia (unintended nerve responses) such as burning sensations in the skin.

Anxiety is often described as a feeling of uneasiness, and it can cause physical symptoms as well. It is normal to feel anxious from time to time, but when anxiety starts taking over and has a negative impact on your life, it’s important to get help.

Some people think that anxiety is the same thing as stress. However, they are not the same things. Although they are related, they are separate issues that need to be treated differently. That’s why the Best cbd gummies for anxiety for anxiety can be very effective in helping you restore your mood and have fewer issues with stress throughout the week.

What causes anxiety?

Anxiety is often caused by a situation, thought, or condition that makes you feel stressed, worried, or frightened. These situations can range from things such as:

Work stress: Jobs can be quite stressful and demanding. All the deadlines, meetings, and presentations can be quite difficult to handle on a daily basis. A job that’s too demanding can cause you to become anxious because you’re worried about meeting all your deadlines. If your job is making you feel overwhelmed and stressed out on a regular basis then it may be helpful to talk with your boss or human resources department about reducing some of your workload in order to reduce the stress.

Financial stress: Whether you have a mortgage, rent, and utility bills to pay or you’re struggling to make ends meet, having financial problems can cause you to feel stressed out. A lot of anxiety can be caused by the pressure of not being able to pay your bills on time or living paycheck to paycheck. If your finances are getting out of control, then it may help to talk to a financial advisor about changing things around so that you don’t feel as stressed about your money troubles.

...A Guide To Payday Loans: Go To MoneyWise

A payday loan is a sort of short-term borrowing in which a lender extends credit at a high-interest rate dependent on your income. The principal is often calculated as a proportion of your future salary. Payday loans have high-interest rates since they are for short-term, emergency credit. They are also known as check advance loans or cash advance loans. To get a payday loan online, Visit https://money-wise.org/.

Utilizing Payday Loans

Payday loans include excessive interest rates and do not require collateral, making them unsecured personal loans. These loans may be called predatory lending since they carry exceptionally high-interest rates, do not take a borrower’s ability to repay, and include hidden conditions that charge borrowers added fees.

Benefits of payday loans:

- Simple to use